5 Steps to Simplify Financial Documentation and Management in 2024

Wading through the labyrinth of finance can feel like trying to find a needle in a haystack. Yet, nailing efficient document management is crucial—especially in today’s fast-paced world. For small business owners and financial pros, leveraging new tech is a game-changer. So, let’s dive into five savvy steps to streamline your financial docs and management in 2024.

1. Embrace AI-Powered Documentation Tools

The financial management scene is shaking things up, thanks to the rise of Artificial Intelligence (AI). AI-driven document management tools are becoming the new office MVPs, handling everything from boring data entry to complex analysis. Apps like QuickBooks and Xero are like financial wizards, using advanced machine learning to magically classify expenses, reconcile accounts, and whip up financial reports. Tools such as an equity management platform don’t just make tedious tasks disappear; they serve up golden insights that can guide your strategic moves.

Key Advantages:

Efficiency: Bypasses routine tasks.

Precision: Curtails human errors.

Insights: Furnishes data-supported recommendations.

2. Utilize Blockchain for Enhanced Security and Transparency

Blockchain technology is shaking up the business world’s approach to managing financial data. By creating an unhackable ledger of transactions, it delivers unmatched security and transparency. This tech is a superstar in auditing, offering a rock-solid record of every financial move.

Key Advantages:

Security: Shields against fraudulent activities and unauthorized modifications.

Transparency: Provides an unvarnished transaction history.

Trust: Fosters credibility amongst stakeholders.

3. Integrate with Cloud-Based Solutions

Cloud-based financial solutions offer unmatched accessibility coupled with real-time data updates. By synchronizing your financial documentation process with platforms such as Google Drive, Microsoft OneDrive, or specialized financial applications, you can manage and update records from virtually anywhere, a godsend for small business owners often managing finances on the move.

Key Advantages:

Accessibility: Retrieve documents from any device.

Real-Time Updates: Guarantees up-to-date data.

Collaboration: Encourages teamwork through shared access.

4. Prioritize Data Visualization

Being able to graphically represent financial data can be a game changer in decision making. Tools like Tableau and Power BI help you craft insightful dashboards that succinctly present crucial financial parameters. These visual aids simplify the understanding of complex data sets and help pinpoint trends, leading to more informed decisions.

Key Advantages:

Clarity: Deciphers complex data.

Insight: Identifies trends and anomalies.

Engagement: Makes data digestible and engaging.

5. Stay Abreast of Current Trends

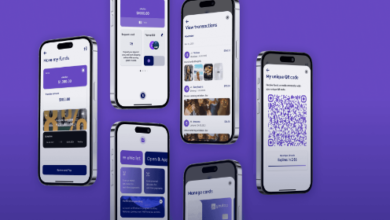

Keeping your fingers on the pulse of emerging trends is vital to maintaining a competitive edge. In 2024, expect a surge in user-friendly interfaces, mobile-first solutions, and enhanced data analytics. Tuning into these trends will keep your financial management techniques efficient and effective.

Key Trends to Watch:

User-Friendly Interfaces: Enhance user experience.

Mobile Solutions: Manage finances on the move.

Advanced Analytics: Extract deeper insights from your data.

All in all, simplifying financial documentation and management in the course of this year is not just feasible but also imperative. By embracing AI-powered tools, utilizing blockchain, integrating with cloud services, emphasizing data visualization, and staying current with emerging trends, small business owners and financial professionals can streamline operations, cut down errors, and make more enlightened decisions. The transformation of your financial management awaits.