White-Label Payments 101: Launch Branded Financial Services Effortlessly

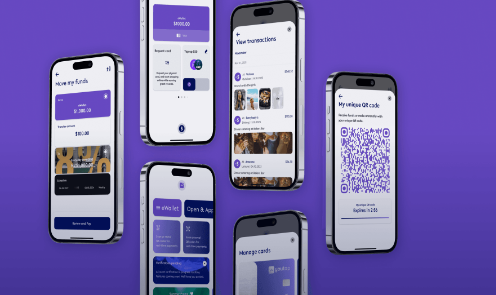

Imagine launching your own payment app or checkout system, complete with your logo, colors, and seamless user experience, all without building from scratch. White-label payments make this reality for businesses eager to offer financial services under their brand. A white-label payment solution provides ready-made infrastructure that you rebrand as your own, powering everything from online checkouts to global money transfer features.

In 2026, as digital commerce explodes, these solutions let startups, e-commerce brands, and fintechs compete like giants. No need for massive dev teams or regulatory hurdles. This 101 guide breaks down the basics, benefits, and steps to launch branded financial services that delight customers and drive revenue through effortless global money transfer capabilities.

What Exactly Is a White-Label Payment Solution?

Think of white-label payments as a turnkey kit. Providers build the core tech, including payment processing, fraud detection, compliance, and APIs. You slap on your branding, customize the interface, and go live. Customers see your name, not the underlying engine.

These solutions handle cards, wallets, bank transfers, and even cryptocurrencies. For global money transfer, they integrate local rails and multi-currency support, making cross-border payouts feel native. Setup involves simple configs: upload logos, set merchant rules, and connect endpoints.

Unlike custom builds costing millions, white-label options launch in weeks. Providers manage updates, PCI compliance, and uptime. Businesses focus on user growth, not plumbing. In a crowded market, your branded checkout stands out, boosting trust and conversions.

Why White-Label Payments Are Booming in 2026

Consumers demand branded experiences everywhere. Generic payment pages scream “middleman,” eroding loyalty. A white-label payment solution keeps users in your ecosystem, from cart to confirmation.

Global money transfer adds urgency. With remote work and e-commerce spanning continents, seamless international payouts win talent and suppliers. Traditional banks lag; white-label platforms deliver instant settlements via modern rails.

Costs plummet too. Building in-house runs 500,000 dollars plus ongoing maintenance. White-label subscriptions start lower, scaling with volume. Marketplaces, SaaS apps, and agencies embed payments effortlessly, monetizing via fees.

Trends fuel adoption. Embedded finance weaves payments into non-financial apps. Regulations favor licensed providers, letting you piggyback compliance. Result? Faster launches and higher margins.

Benefit 1: Rapid Time-to-Market

Speed kills in tech. White-label payment solutions deploy in days, not years. Pre-built modules cover 90 percent of needs: subscriptions, one-click buys, and global money transfer flows.

Customize via drag-and-drop editors or APIs. Test in sandboxes before going live. E-commerce sites add branded checkouts mid-season, capturing holiday surges without downtime.

For startups, this means pitching investors with working demos. Enterprises refresh legacy systems overnight. Launching branded financial services turns ideas into revenue streams fast.

Benefit 2: Full Branding and User Experience Control

Your brand is your moat. Generic flows leak users to competitors. White-label lets you dictate every pixel: button styles, success screens, and error messages.

Integrate with your app’s design language for stickiness. Customers complete global money transfer without leaving your domain, reducing abandonment. Personalized journeys lift conversions 15-30 percent.

Analytics tie back to your dashboard. Track drop-offs, A/B test flows, and optimize. Branded financial services feel native, building long-term equity.

Benefit 3: Cost Efficiency Without Sacrificing Features

Development eats budgets. White-label payment solutions shift fixed costs to variable ones. Pay per transaction or monthly, aligned with growth.

Feature parity matches custom builds: 3D Secure, tokenization, fraud scoring, and multi-language support. Global money transfer shines with 100+ currencies and local methods like instant bank transfers.

No hiring specialists for compliance or uptime. Providers handle chargebacks, disputes, and audits. Savings compound as you scale, freeing cash for marketing.

Benefit 4: Scalability for Global Expansion

Growth stresses systems. White-label platforms process billions monthly, auto-scaling for Black Friday or viral campaigns. Add countries or methods via toggles.

Global money transfer becomes plug-and-play. Payout to freelancers in Asia or suppliers in Europe without new integrations. Volume discounts kick in automatically.

High availability guarantees 99.99 percent uptime. CDNs and edge computing ensure speed worldwide. Branded financial services scale from 10 to 10,000 transactions daily.

Benefit 5: Built-In Compliance and Security

Regulations intimidate. White-label payment solutions carry licenses across jurisdictions. PCI Level 1, GDPR, and AML come standard, with automated KYC flows.

Fraud engines use AI to score risks in real-time. Velocity checks, device fingerprinting, and geo-blocks stop bad actors. Global money transfer includes sanctions screening.

Auditors love plug-and-play reports. No scrambling for logs during reviews. Launch branded services confidently, letting providers sweat the red tape.

Who Should Use White-Label Payments?

E-commerce platforms top the list. Embed checkouts that match your store, lifting average order values. Marketplaces pay sellers instantly via branded dashboards.

SaaS companies bill globally without friction. Subscription management and dunning live under your brand. Agencies white-label for clients, reselling as value-add.

Fintechs and neobanks layer payments atop core apps. Gaming sites handle microtransactions seamlessly. Any business monetizing transactions benefits from white-label efficiency.

Key Features to Demand in a White-Label Solution

Payment methods: 200+ options, including cards, ACH, SEPA, and wallets. Global money transfer needs local coverage for high acceptance.

APIs and webhooks for deep integrations. No-code builders for quick MVPs. Multi-currency wallets to hold funds pre-conversion.

Reporting suites with cohort analysis and churn prediction. Mobile SDKs for apps. Payout automation for marketplaces.

Support tiers: 24/7 chat, dedicated managers, and SLAs. Custom dev for unique flows.

Steps to Launch Your White-Label Payment Solution

Assess needs. Map transaction types, volumes, and markets. Budget for setup and ongoing fees.

Shortlist providers via demos. Test flows end-to-end: checkout, refund, dispute. Check global money transfer speeds to key regions.

Integrate incrementally. Start with core payments, layer fraud and analytics. Migrate traffic gradually to minimize risk.

Launch with promos. Offer fee waivers to drive adoption. Monitor metrics closely first month.

Optimize quarterly. A/B test UIs, expand methods, and negotiate rates as volume grows.

Common Pitfalls and How to Avoid Them

Lock-in traps data. Demand export tools and standard APIs. Hidden fees hide in fine print; model total costs.

Over-customization bloats timelines. Stick to 80/20 features first. Poor support strands you; prioritize responsive teams.

Scalability gaps emerge at volume. Stress-test during pilots. Compliance drift happens; audit licenses yearly.

Choose partners with proven scale. User forums reveal real-world quirks.

The Future of White-Label Payments

AI personalizes flows, suggesting methods per user. Blockchain enables instant global money transfer without intermediaries.

Embedded finance explodes, with payments in social apps and games. Voice and biometric checkouts go mainstream. Sustainability tracking measures transaction carbon footprints.

By 2027, white-label solutions power 60 percent of digital commerce. Early adopters own branded financial services ecosystems.

White-label payment solutions democratize finance. Launch effortlessly, brand boldly, and scale globally. Your customers await seamless experiences.

Ready to white-label? Start with a demo today.